Washington DC Condos

There’s a tremendous amount of info to absorb about Washington DC condos. To help you apply it to your transaction, we’ve compiled a comprehensive page of ‘must know’ information, along with valuable resources and links you can use when the time is right.

The Basics | Washington DC Condos

A Washington DC condominium isn’t a certain type of building or architecture. It can take many different shapes and forms. Primarily, it’s ownership of an individual share in an owner’s association. The definition of a condo “unit” is defined in the governing documents. It can be anything from a commercial or industrial building to a boat dock. Here are the basics on residential condo ownership:

- Purchasers of a condominium unit will receive a deed to the unit, and a percentage interest in the common elements;

- Association dues are based on unit size plus any additional components, including limited common elements controlled by the unit owner, such as parking and storage spaces;

- Unit owners must abide by the rules and restrictions set forth in the association bylaws;

- A standard mortgage loan can be used to purchase a condominium;

-

Unit owners may run for a seat on the condo board;

- Depending on the rules, unit owners may have the ability to lease the unit;

-

Unit owners may sell a condominium unit at will.

Why Condominium Ownership?

Bullet Points

- Assess the association’s financial health

- Review bylaws and CC&Rs

- Research governing board and management company

- Review new condominium public offering statement

Adriana

Susan and Alex are amazing! After a bad experience with another agent left us in a very tough position, they turned everything around. They did a thorough evaluation of the property, offered expert advice and helped to prepare the condo for sale. They also supervised improvements to the property. Susan and Alex worked very hard, used local connections and communicated with us well. Despite the tough August market, we sold in less than 2 weeks. We highly recommend them for anyone who is looking for a competent local agent, with knowledge of the market and a great work ethic.

Financing DC Condos

- A DC condominium may be financed with a comventional mortgage loan, or alternative loan types. Comsult a mortgage lending professional for options

- Many DC condominiums qualify for FHA and VA lending. These options are specific to each condominium. Your lender should have a current list of DC condos qualifying for either loan type

- Condos must be FHA approved to qualify for a Home Equity Conversion Mortgage (HECM) reverse mortgage loan

- ‘Condotels‘ and ‘condops‘ may not qualify for Freddie Mac or Fannie Mae underwritten mortgagtes

- The condominium must be “warrantable” in order to qualify for Freddie Mac and Fannie Mae underwritten mortgage loans. Non-warrantable condos are considered higher risk for lenders and buyers, and usually require alternative financing options. A condominium with some or all of the following conditions may be considered non-warrantable:

- Condominiums with excessive delinquent dues/assessments, single entity ownership, or investor ratios may not qualify for many types of financing

- Condominiums with pending litigation, severely limited or no reserves for capital expenditures, and deferred maintenance may not qualify for many types of financing

- Projects in which unit owners do not possess sole ownership of the Common Elements may not qualify for many types of financing

- Other factors. See Freddie Mac and Fannie Mae guidelines.

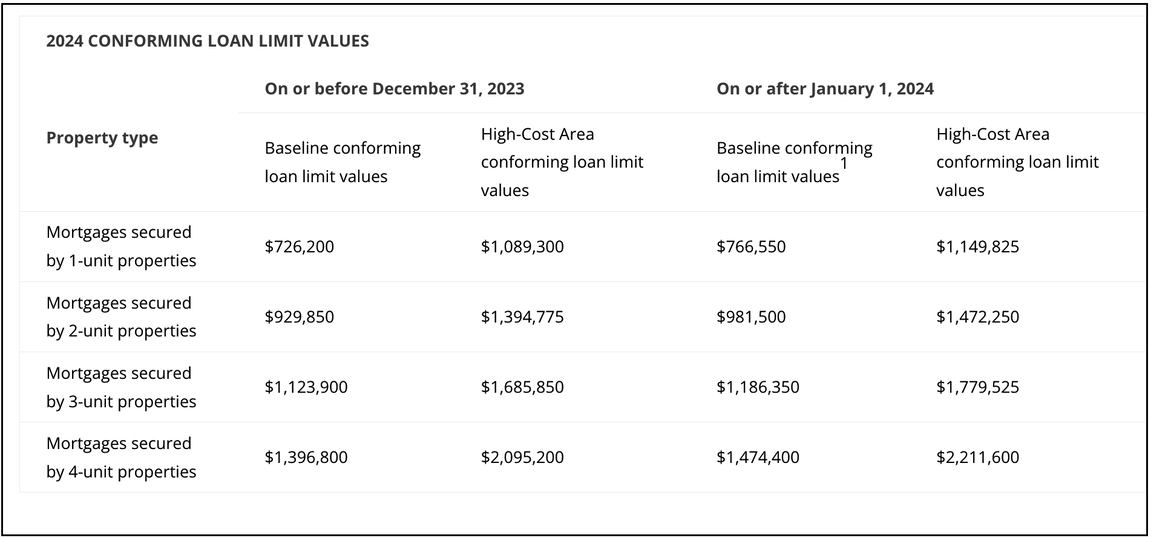

2024 CONFORMING LOAN LIMITS

Feddie Mac baseline conforming loan limit values and designated High-Cost Area loan limits increase effective January 1, 2024.

Actual conforming loan limit values for specific counties in designated High-Cost Areas, as determined by the FHFA, may be lower than the amounts listed above and can be found by visiting the FHFA conforming loan limit values webpage.

For conforming Mortgages secured by properties in designated High-Cost Areas, notwithstanding the loan limit values shown in the above chart, Sellers must review the 2024 conforming loan limit values permitted for the specific county in which the property is located. The FHFA provides this information on its website.

High-Cost Areas applicable to the First-Time Homebuyer Credit Fee Cap, as described in Guide Exhibit 19A, Credit Fee Cap Eligibility Criteria, will be determined based on whether the Mortgaged Premises is located in a High-Cost Area as of the Application Received Date or the Note Date. Loan Selling Advisor® will determine whether the Mortgaged Premises is located in a High-Cost Area.

Resale Certificate Packages

Commonly known as “condo docs,” this package provides buyers of DC condos with a overview of the property’s finances, rules and regulations, and other materials pursuant to “DC Code Section 42-1904.11. Resale by unit owner.” Here’s what’s typically included:

The unit owner shall obtain from the unit owners’ association and furnish to the purchaser on or prior to the 10th business day following the date of ratification of the contract of sale, a copy of the condominium instruments and a certificate setting forth the following:

- Appropriate statements pursuant to Section 42-1903.13(h) and, if applicable, Section 42-1903.15, which need not to be in recordable form;

- A statement of any capital expenditures anticipated by the unit owners’ association within the current or succeeding 2 fiscal years;

- A statement of the status and amount of any reserves for capital expenditures, contingencies, and improvements, and any portion of such reserves earmarked for any specified project by the executive board;

- A copy of the statement of financial condition for the unit owners’ association for the then most recent fiscal year for which such statement is available and the current operating budget, if any;

- A statement of the status of any pending suits or any judgments to which the unit owners’ association is a party;

- A statement setting forth what insurance coverage is provided for all unit owners by the unit owners’ association and a statement whether such coverage includes public liability, loss or damage, or fire and extended coverage insurance with respect to the unit and its contents;

- A statement that any improvements or alterations made to the unit, or the limited common elements assigned thereto, by the prior unit owner are not in violation of the condominium instruments;

- A statement of the remaining term of any leasehold estate affecting the condominium or the condominium unit and the provisions governing any extension or renewal thereof; and

- The date of issuance of the certificate.

If the required instruments and certificate are not furnished to the purchaser on or prior to the 10th business day following the ratification date of the contract of sale, the purchaser shall have the right to cancel the contract by giving notice in writing to the seller prior to receipt of the condominium instruments and certificate, but not after conveyance under the contract.

Right Of Rescission

Purchasers of Washington DC condominiums and cooperatives are guaranteed a specific term for review of association documents by law.

The term varies for new construction, resales and home type.

EXCEPTIONS AND RECOMMENDATIONS

Smaller associations and self-managed associations may not be required to offer the same resale packages as larger, professionally managed associations. Check the provisions in the DC Condo Act for clarity, and consult a professional to assist you with review.

Buyer Due Diligence

RESALE CERTIFICATE PACKAGE

Review:

- Current budget and financial condition, reserve funds

- Current Bylaws, architectural guidelines, CC&Rs (Covenants, Conditions and Restrictions), rules and regulations

- Monthly association fee and capital contribution

- Master Insurance Policy coverage

- Occupation limitations (number of people who may occupy a unit)

- Statement of unpaid fee assessments, special assessments, and/or planned assessments

- Records of current/pending legal action or judgements by or against the developer, association, board or unit owner

- Certification of filing for the association’s annual report to state board (some associations exempt)

- Records of approved alterations to the unit, if any

- Violation notices to current unit owner(s)

- Delinquent fees for unit/owner

- New condos: See our new construction section below

PAY PARTICULAR ATTENTION TO:

- The financial condition of the association or corporation managing the property

- The condominium’s investor ratio (owner-occupents vs renters) and cap, if any on rentals (subject to percentage caps that can render a building unwarrantable)

- Rental restrictions, if any

- Pet restrictions, if any

- Smoking restrictions, if any

- Percentage of association’s commercial property square footage, if any (retail components) subject to percentage caps that can render a building unwarrantable

- Percentage of delinquent dues by owners and duration of delinquencies (subject to percentage caps that can render a building unwarrantable)

- Board member term limits

- Levied or planned special assessments

- Liens or judgements against the association

- Repairs in progress, or a schedule of planned repairs, for association

- Improvements or alterations made to the unit. Are they in compliance with board/association regulations and standards? Did the unit owner obtain the proper permitting and inspections, if required?

- Frequency and increments of dues increases. Is there an annual cap on increases?

- Reserves for major repairs or improvements

- Age and condition of major components such as roofs, HVAC systems, plumbing and electrical, elevators, common area elements

- Minutes for the past 3-6 board meetings. Review for discussions of expenditures, repairs, legal proceedings and other issues that might shed light on the association’s future spending and assessment plans, or issues the association or unit owners are experiencing.

THE DC HOMESTEAD DEDUCTION

Owners of condominium units may be eligible to receive the benefits of the District of Columbia Homestead Tax Dedcuction.

This benefit reduces your real property’s assessed value by $84,000 (savings of $714.00) prior to computing the yearly tax liability.

The Homestead benefit is limited to residential property. To qualify:

- An application must be on file with the Office of Tax and Revenue;

- The property must be occupied by the owner/applicant and contain no more than five dwelling units (including the unit occupied by the owner); and

- The property must be the principal residence (domicile) of the owner/applicant.

If a properly completed and approved application is filed from October 1 to March 31, the property will receive the Homestead benefit for the entire tax year (and for all tax years in the future). If a properly completed and approved application is filed from April 1 to September 30, the property will receive one-half of the benefit reflected on the second-half tax bill (and full deductions for all tax years in the future).

The DC Condo Act & Legislative Updates

Familiarize yourself with the DC Condo Act. This is the governing legistlation for condominiums in the District.

THE ACT (DC)

- The DC Condo Act of 1974 regulates condominium and cooperative creation, association governance and affairs.

DC LEGISLATIVE UPDATES

- The District of Columbia Condominium Act of 1974 was amended in 2022, effective in 2023;

- The Act was amended in 2016. The Condominium Owner Bill of Rights and Responsibilities Amendment Act of 2016, became effective April 7, 2017;

- The Act was amended in 2014.

D.C. Law 24-262. Condominium Warranty Claims Clarification Amendment Act of 2022

WHAT WAS CHANGED

Highlights:

- The definition for the term “structural defect” was expanded to include DC building code for violations resulting in ‘demonstrable harm’ to the health or safety of residents, or if units are conveyed before a Certificate of Occupancy is issued by the DoB, or prior to substantial completion of the condominium;

- The ‘resulting damage’ caused by a structural defect may now require tbe developer to repair as part of its warranty obligations. Developers were previously responsible solely for correcting the defect, not necessarily liable for any resulting damages;

- Requires developers to obtain certified documentation for the project’s estimated “hard costs” and supplement their 10% bond with additional funds if actual costs exceed estimated costs by a certain amount. The Mayor must establish a searchable online database for condominium bonds.

- Clarifies the deadline for submitting a claim on the developer’s bond. The warranty period is two years from the date of sale, but the time to file claims will be 5 years from the date of sale. Notice and response provisions have been established for associations and developers to follow prior to making claims with the city.

- The Act prohibits condominium instruments from restricting an association from asserting claims for defects against a developer. Previously, developers could (and would) insert procedural roadblocks in the condominium instruments designed to discourage associations from asserting claims. These included requiring an association to engage in mandatory alternative dispute resolution (mediation or arbitration);

- Added with this Act are provisions for appeals of any warranty bond decision to DC’s Office of Administrative Hearings;

- The Act requires a Claims Fund to be established for financial assistance to associations making claims on the warranty bond, for expenses such as inspections, cost estimates, and attorneys’ fees. Eligibility is based on financial need.

WHO IS AFFECTED | EFFECTIVE DATE

These legislative changes to the DC Condominium Act will affect:

- Condominium boards

- Unit owners

- Project developers

The temporary legislation became effective January 10, 2023. The permanent version went into effect in March 2023.

SOURCES AND RESOURCES

Freddie Mac & Fannie Mae Updated Condo | Co-Op Guidelines 2023

In cooperation with the FHFA, Government-sponsored enterprises (GSEs) Freddie Mac and Fannie Mae updated their guidance for condominiums and cooperatives.

The 2023 changes come two years after issuance of a 2021 letter by Fannie Mae that created temporary requirements for condos and co-op projects, prompted by the partial collapse of Champlain Towers South condominium in Florida that killed 98 people and injured 14 others.

WHAT WAS CHANGED

Project standards policies for properties in need of critical repairs and special assessments.

The project review requirements update is intended to assist lenders in identifying projects that may have issues resulting in unsafe conditions.

SOURCES AND RESOURCES

FANNIE MAE UPDATE

These requirements apply to all loans secured by units in condo projects (condo loans) and all cooperative share loans secured by share ownership in a co-op project (co-op share loans) with five or more attached units, regardless of the project review type.

The requirements also apply to loans eligible for delivery under the waiver of project review policy. These project review requirements:

▪ Define critical repairs, material deficiencies, and significant deferred maintenance, including defining routine repairs that are not considered critical;

▪ Prohibit sale of condo loans and co-op share loans in projects in need of critical repairs;

▪ Prohibit sale of condo loans and co-op share loans in projects with current evacuation orders due to unsafe conditions;

▪ Require a review of all structural or mechanical inspection reports that have been completed within 3 years of the project review date;

▪ provide new requirements for condo or co-op projects with special assessments;

▪ prohibit sale of condo loans and co-op share loans in projects with unfunded repairs totaling more than $10,000 per unit, and;

▪ prohibit sale of condo loans and co-op share loans in projects that have an “Unavailable” status in Condo Project Manager™ (CPM™).

This guidance can be found in Fannie Mae’s Selling Guide Update which was created in cooperation with the Federal Housing Finance Agency (FHFA).

FREDDIE MAC UPDATE

Freddie Mac’s new guidance was presented as an update to its Condo Project Advisor. All requirements became effective on September 18 2023.

In its messaging to lenders, Freddie Mac wrote:

“On July 29, 2023, we’ll update the “Incomplete Assessment” feedback message in Condo Project Advisor® to indicate when a condo project may need critical repairs. Here’s what you [lenders] need to know:

Updated “Incomplete Assessment” Feedback Message

- Currently, if a Project Assessment Request (PAR) submitted to Condo Project Advisor receives an “Incomplete Assessment” feedback message (CPAX1013), that’s an indication that the tool can’t assess the project. This includes the requirement in Section 5701.3(n) that a project is ineligible for sale to Freddie Mac if it needs critical repairs.

- On July 29, 2023, we’ll make things easier for you [lenders] by updating one of the “Incomplete Assessment” messages to alert you that the project may need critical repairs. You can determine whether or not a project does indeed require repairs. This can assist you in determining compliance with Guide Sections 5701.2(a) and 5701.2(b).”

Other Freddie Mac Updates:

- 2024 conforming loan limit values

- New conforming loan limit values for 2024 – January 1, 2024

- Employed income documentation and verification requirements

- A 10-day pre-closing verification (PCV) update

- Cash-out refinance Mortgages

- A requirement that all Borrowers must occupy the property when the Mortgage is secured by a Primary Residence – March 6, 2024

- Condominium Projects

- The addition of a new Project Assessment Request finding status, Not Eligible, to Condo Project Advisor® – February 26, 2024

- Project Certified Submission (PCS), an enhancement to Condo Project Advisor – December 8, 2023

- The reorganization of certain content in Guide Chapter 5701 – December 8, 2023

Condo Q&A

WHAT ARE BYLAWS AND CC&Rs?

Condominium associations are run according to three types of governing documents: Covenants, Conditions & Restrictions, Rules & Regulations, and Bylaws:

- CC&RS (covenants, conditions, and restrictions) are the package of governing instruments for condominium communities. They stipulate condo owner responsibilities and regulate the use, appearance and maintenance of units and common areas. CC&Rs also define responsibilities and procedures of the condominium board in relation to owners, including rule enforcement and resolution protocols, and insurance requirements, among other aspects of condominium governance.

- Bylaws are instruments that dictate matters primarily pertaining to the Board itself, such as election procedures, the various board positions and their associated responsibilities, as well as rules for board governance in general.

- Rules and Regulations are concerned with more detailed matters relating to property use, such as smoking prohibition or restrictions, when and how common areas such as fitness centers, pools, atheletic courts, grilling stations, roofdecks and party rooms can be utilized, and pet restrictions. ‘Rules and Regulations’ is the most often-amended set of condominium instrunents.

CAN I INSTALL AN IN-UNIT WASHER|DRYER?

The short answer is “maybe.”

Your condominium’s rules and regulations should include a section on installation of in-unit washers and dryers.

Buyers searching for properties with the potential for addition of these appliances can filter listings with building amenities that include ‘community laundry,’ This notation might indicate that the building is not set up for individual installs.

Older DC condo buildings may not have made the plumbing and electrical improvements necessary to facilitate the use of in-unit washers and dryers.

If the building has a community laundry, but the listed unit includes ‘in-unit washer/dryer,’ check with the management company to confirm that such an upgrade is ‘legal’ according to the condominium rules, and that proper steps, such as board and/or architectural review, were followed and the install was formally approved.

If plumbing was altered or added for such an improvement, a permit is required. Check with the Department of Building and/or DC Scout records to confirm that a permit was obtained and the work inspected.

Violations for un-approved washers and dryers, as well as permit violations, can result in the appliances’ removal and repair to any components not approved or meeting code. These violations transfer to purchasers, so it’s important to conduct your due diligence.

WHAT IS A 'CAPITAL CONTRIBUTION'?

A capital contribution fee is “seed money” paid at closing that is not credited to the unit owner’s account but instead to the association as working capital for the condominium project.

Typically equivelent to two, sometimes three, months’ dues, this fee is assessed by nearly every condominium in the District.

WHAT IS A 'SPECIAL ASSESSMENT'?

When the need for major repairs, updates or additions becomes necessary, or deferred maintenance reaches a critical point, a condominium association may find it does not have sufficient reserves to fund the project. A special assessment to unit owners may be the best alternative to raising monthly dues, which may be insufficient for the purpose.

Special assessments are levied based on unit size, and may be paid in one lump sum, or in small additions to monthly dues that continue until the payment is complete or the unit is sold, in which case the seller may pay off the remainder of the assessment or it may be assumed by the buyer, according to the terms of their purchase contract.

Unit owners can protest a special assessment as unwarranted by filing a complaint with the condo association. This has a small chance of success unless the majority of owners agree and do the same.

Some insurance types may cover all or a portion of special assessements. Standard condo insurance on its own likely will not, but there are riders available for purchase for “loss assessment coverage” that should, and reportedly, Nationwide’s base condo insurance policy is said to includes loss assessment coverage.

ARE DC CONDOS A GOOD INVESTMENT?

It depends on the project quality and scope, it’s location and proximity to amenities DC residents consider vital, such as Metro access, groceries, and restaurants. Neighborhood reputation and conditions play a large part in value, as do:

- Market conditions

- Unit size and floor level

- Floor plan and unit attributes

- Building amenities, including concierge and package room

- Monthly condo dues

- Parking

- Storage

- Views

- Elevators

- Builder reputation

- Management quality

Condominiums are often the first property type to drop in value when the market declines, and the last to recover., so it’s important to choose a project and unit that have as many positive attributes as possible.

WHAT'S THE DC CONDO BILL OF RIGHTS?

In DC, every condominium unit owner who’s a member of a unit owners’ association has certain rights and responsibilities under the D.C. Condominium Act.

ARE CONDO ASSOCIATIONS REGULATED IN DC?

District of Columbia condominiums are regulated by the DC Condominium Act of 1976.

The Act was amended to include an Owner’s Bill of Rights with enactment of D.C. Law 21-241. Condominium Owner Bill of Rights and Responsibilities Amendment Act of 2016.

The Condominium Act of 1976 Technical and Clarifying Amendment Act of 1992 (D.C. Law 9-82) regulates the formation, governance, registration and the sale of condominium units; D.C. Official Code § 42-1901-01 et. seq. (2001), as amended.

The Rental Housing Conversion and Sale Act of 1980, as amended (D.C. Law 3-86) regulates conversion of property into a condominium or cooperative, relocation assistance, the tenant organization registration, the registration of rental residential property offered for sale and tenant opportunity to purchase rights. D.C. Official Code § 42-3401.01 et. seq. (2001), as amended District of Columbia Municipal Regulations, title 14, chapter 47

DHCD, the District’s Department of Housing, is responsible for:

- Affordable Dwelling Units

- Condo and Co-op Conversion and Sales

- Housing Provider Ombudsman

- Housing Counseling

- Housing Resource Center

- Inclusionary Zoning

- Rent Control

The U.S. Department of Housing and Urban Development is responsible for enforcing the federal Fair Housing Act, which prohibits discrimination in the sale, rental, and financing of dwellings, and in other housing-related transactions, because of race, color, religion, sex, familial status, national origin, and disability.

The

CAN I SUE A CONDO ASSOCIATION & BOARD?

District of Columbia Washington DC condominium owners can sue condominium associations, potentially even board members.

This is a legal question, and we are not attorneys. Here are some paraphrased responses from online experst & authorites:

Board members have certain fiduciary duties to uphold, which include the duty of care. Failure to uphold these duties can result in homeowners suing condo associations for negligence.

Embezzlement of corporate funds, fraud and self-dealing can deplete Association assets and harm owners. In this circumstance, unit owners may want to sue the offending Board member(s). Such a lawsuit is called a derivative action.

Condo board members use the Business Judgement Rule to protect themselves from liability. According to the law, the board of directors is immune from personal liability when it can be proven that their actions or decisions were reasonable and made in good faith.

Typically, the Business Judgement Rule decides in favor of the Board. Board seats are volunteer positions. Few or no community members would agree to provide unpaid service to the board if they could be held legally liable for unpopular decisions. A judge may dimiss the case if the board member(s) are perceived to have acted within the scope of their authority, not fraudulently or unconscionably, even if the decision-making in question was likely poor.

To prevail, a unit owner must establish that the condo board member(s) failed to uphold their fiduciary duty to act in the best interest of the association.

Sources:

DC Code § 42–1902.09. Compliance with condominium chapter and instruments:

(a) Any lack of compliance with this chapter or with any lawful provision of the condominium instruments shall be grounds for an action or suit to recover damages or injunctive relief, or for any other available remedy maintainable by the unit owners’ association, the unit owners’ association’s executive board, any managing agent on behalf of the unit owners’ association, an aggrieved person on his or her own behalf, or, in an otherwise proper case, as a class action.

(b) The decisions and actions of the unit owners’ association and its executive board shall be reviewable by a court using the “business judgment” standard. A unit owners’ association shall have standing to sue in its own name for a claim or action related to the common elements. Unless otherwise provided in the condominium instruments, the substantially prevailing party in an action brought by a unit owners’ association against a unit owner or by a unit owner against the unit owners’ association shall be entitled to recover reasonable attorneys’ fees and costs expended in the matter.

(Mar. 29, 1977, D.C. Law 1-89, title II, § 209, 23 DCR 9532b; Mar. 8, 1991, D.C. Law 8-233, § 2(m), 38 DCR 261; June 21, 2014, D.C. Law 20-109, § 2(c), 61 DCR 4304.)

WILL YOU REVIEW MY CONDO DOCS?

Your own due diligence is required. Only you can decide if you’re comfortable with the terms of the association documents. By law, real estate agents are not permitted to act as CPAs or attorneys unless they are licensed for this purpose. You can solicit the assistance of theese professionals if the need arises.

TELL ME MORE ABOUT CONDO ASSOCIATIONS

Condominium Associations are similar in many respects to Home Owner Associations, but differ in some ways. The CC&Rs are the rules that govern homeowners and these should be reviewed with care prior to a purchase.

Also important for new condo buyers is the process following the transfer of the board from developer control to homeowner control. Read all about it on our Associations page.

About Warrantability

What makes a condominium warrantable or non-warrantable? What does the term mean and how does it affect buyers? Who sets the standards for warrantability?

Mortgage lenders like Fannie Mae and Freddie Mac consider some condos to be high risk under certain circumstances. When they deem this the case, they will decline to buy loans related to the condo, which places the property in the non-warrantable category.

WHAT IS 'WARRANTABILITY'?

Compliance with standards set by Fannie Mae and Freddie Mac for mortgage lending. A property that does not meet these standards is deemed “unwarrantable.”

FANNIE MAE AND FREDDIE MAC

Fannie Mae and

The Federal National Mortgage Association (FNMA, or “Fannie Mae”) and Federal Home Loan Mortgage Corporation (FMCC, or “Freddie Mac”), AKA “Government-sponsored enterprises (GSEs),” were created by Congress in 1938 and 1970 respectively, to provide liquidity (ready access to funds on reasonable terms) to thousands of banks, savings & loans, and mortgage companies.

The Enterprises purchase mortgages from lenders and hold them in their portfolios, or package them into mortgage-backed securities (MBS) that may be sold.

Freddie and Fannie help ensure that Americans have a continuous, stable supply of mortgage money available. By packaging mortgages into MBS and guaranteeing the timely payment of principal and interest on the underlying mortgages, Fannie and Freddie attract to secondary mortgage market investors who might not otherwise invest in mortgages, expanding the pool of funds available for housing, providing increased liquidity to the secondary mortgage market , and helping to lower interest rates paid by mortgage borrowers.

Fannie Mae and Freddie Mac also can help stabilize mortgage markets and protect housing during extraordinary periods when stress or turmoil in the broader financial system threaten the economy.

WARRANTABILITY STANDARDS

Each GSE has its own standards. While there are similarities in their warrantability criteria, there can also be some nuanced differences. It’s important to note that these standards may evolve, as seen with the updates on this page, and potential borrowers are advised to consult a mortgage broker and check the most recent guidelines from Freddie Mac and Fannie Mae for the latest information. Here are some general points regarding the Enterprises’ warrantability standards:

Freddie Mac

- Loan Eligibility Requirements: Freddie Mac provides guidelines and requirements for various loan types, including conforming and non-conforming loans.

- Loan Limits: Freddie Mac establishes maximum loan limits that are eligible for purchase. Loans that exceed these limits may be considered non-warrantable.

- Credit Score Requirements: Freddie Mac sets standards for borrower credit scores, and loans that fall below these standards may not be warrantable.

- Loan-to-Value (LTV) Ratio: Freddie Mac has specific requirements regarding the maximum loan-to-value ratio for warrantable loans.

- Property Types: There may be specific guidelines for certain types of properties, such as condominiums or cooperative units.

Fannie Mae

- Loan Eligibility Guidelines: Similar to Freddie Mac, Fannie Mae sets guidelines for various types of loans, including conforming loans.

- Loan Limits: Fannie Mae also establishes maximum loan limits, and loans exceeding these limits may not be warrantable.

- Credit Score Standards: Fannie Mae has specific credit score requirements for warrantable loans.

- LTV Ratio: Fannie Mae provides guidance on acceptable loan-to-value ratios for warrantable loans.

- Property Standards: Fannie Mae may have specific requirements for the condition and type of the property being financed.

Common Elements

- Documentation Standards: Both Freddie Mac and Fannie Mae have documentation standards that lenders must adhere to for a loan to be considered warrantable.

- Underwriting Standards: Both GSEs have underwriting standards that focus on the borrower’s ability to repay the loan.

Keep in mind that these are general points, and specific details can–and will–change. Mortgage lenders typically follow these guidelines when originating loans that they intend to sell to Freddie Mac or Fannie Mae. Consult with your mortgage professional for the most current requirements.

HOW WARRANTABILITY AFFECTS CONDOMINIUMS

Warrantability affects everyone, from cash buyers to those who finance, as well as sellers, because non-warrantable condos restrict the types of financing possible for purchase of a unit. When standard lending is not available, buyers must search for specialty loans that carry higher interest rates and carry larger down payment requirements. Sometimes a commercial mortgage loan is not available at all, and a buyer must look to private lenders. When the buyer pool is reduced, properties typically take longer to sell, and sell for less. This may be seen as an advantage by some investors and long-term owners, but its important to remember that non-warrantability will also restrict ability to obtain HELOCs and cash-out refinancing.

Disclaimer

We are not attorneys, legal experts or CPAs. The information presented on this site and page is derived from reliable sources, but may be paraphrased, incomplete, or outdated and should not be considered legal, financial or investment advice. The Isaacs Team LLC, DOMO of Compass, and Compass, their principals and/or representatives, do not guarantee or warrant its accuracy, completeness, or applicability to any specific transaction. Homebuyers should read applicable D.C. code themselves, and seek help from a licensed, qualified professional for interpretation and application to their specific transaction.